Check out the “HR Executives’ Perspective on Employee Financial Health” survey results report.

Continue reading2021 Annual Nonprofit Salary Report Released!

For the last 20 years, PNP STAFFING GROUP has published annual SALARIES and STAFFING TRENDS REPORTS for NYC, DC, and Philadelphia. These reports provide nonprofit managers with critical information

Continue reading10 Tips for Nonprofit Managers Working with Newly Remote Teams

Nonprofit Staffing During the Pandemic reported that in July 2020, most nonprofits had at least 75% of staff working from home, and 61% reported in September that 100% of their staff were working remotely.

Continue reading2020 Annual Nonprofit Salary Report will be released November 30, 2020

About the Salary Report

For the last 20 years, PNP STAFFING GROUP has published annual SALARIES and STAFFING TRENDS REPORTS for NYC, DC, and Philadelphia. These reports provide nonprofit managers with critical information on salaries and hiring trends in the sector so that organizations have the information needed to be able to compete more effectively for talent in the marketplace. This year’s report will be available at the end of November for free on PNP’s website, www.pnpstaffinggroup.com.

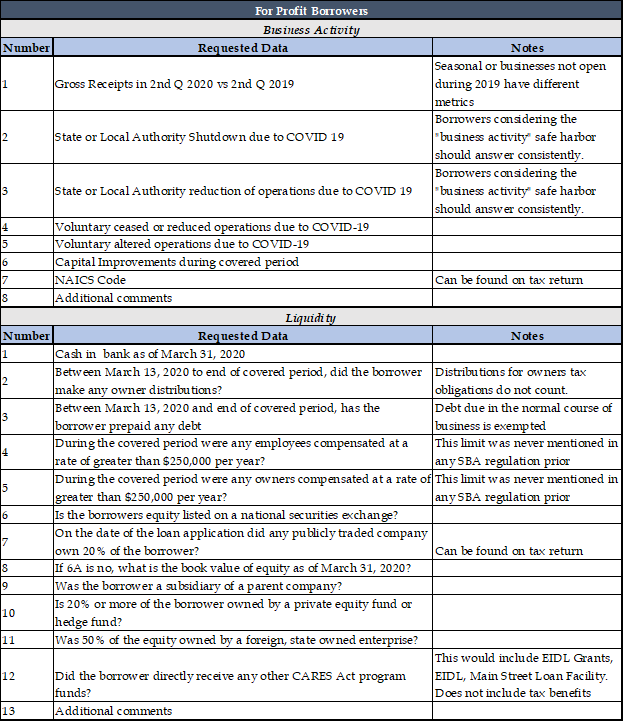

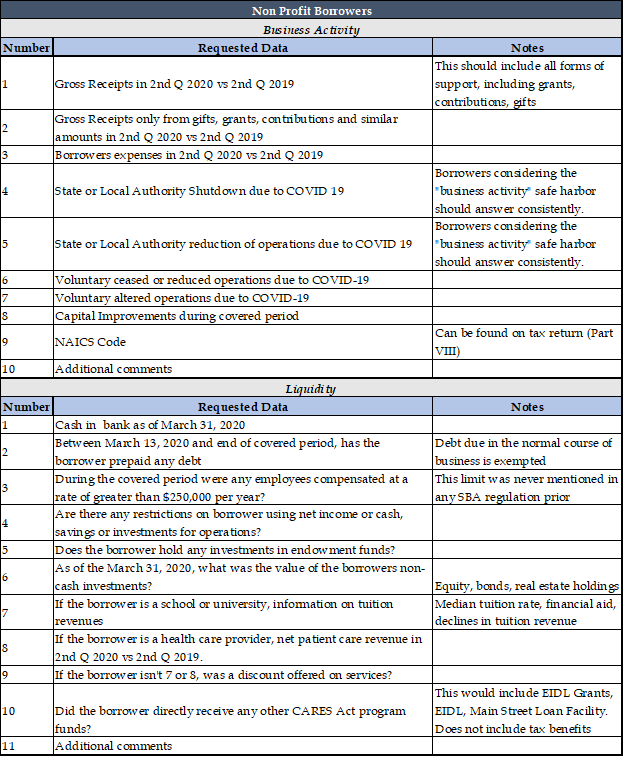

SBA Necessity Questionnaire Released for Borrowers with PPP Loans Over $2,000,000

In what is likely the first step in the audit process for borrowers that received Paycheck Protection Program (PPP) loans more than $2,000,000 (including affiliates), the SBA has developed a questionnaire for both for-profit and non-profit borrowers which was released on Thursday, October 29, 2020. This questionnaire will be used to “facilitate the collection” of information that the SBA will use to “evaluate” the good-faith certification made on the PPP loan borrower application.

To refresh, during the initial PPP Loan application, borrowers had to certify that “current economic uncertainty makes this loan request necessary to support the ongoing operations of the Applicant.” However, at no point did the SBA provide any material guidance as to what this certification meant, leaving many borrowers flustered. The limited guidance at the time only stated borrowers must take into account their current business activity and their ability to access other sources of liquidity. The FAQ mentioned that public companies with substantial market value would not be able to make this in good faith, nor would companies owned by hedge funds or private equity firms.

The forms were authorized in the Federal Register on October 26th, 2020 and known in that document as Form 3509 and 3510. At this time, these forms are NOT available on the SBA or Treasury website, but copies can be found here and here for non-profit borrowers. It is anticipated at this time that these questionnaires will come directly from the lender and/or servicer and is required to be returned within 10 business days of receipt.

The questionnaire can be broken down into 2 separate components – a business activity component and a liquidity assessment component. Borrowers can mark to keep their answers confidential (all borrowers should consider this). Each question has space to allow for explanations as necessary and use March 13, 2020 as the focus date (meaning all answers are for the period of March 13, 2020 onward) for business activity.

For borrowers with loans (including affiliates) totaling less than $2,000,000 the release of this questionnaire has no immediate impact, and they will not be required to complete it at this time. These borrowers are automatically considered to have made the certification in good-faith pursuant to SBA FAQ 46, which explicitly states “Any borrower that, together with its affiliates, received PPP loans with an original principal amount of less than $2 million will be deemed to have made the required certification concerning the necessity of the loan in good faith.” This questionnaire feels very “Monday Morning Quarterback” by the SBA. Many of the responses require information that could only have been obtained after the certification was made to obtain the loan. Further, some of the questions asked were never brought up as issues during the application process, such as employee compensation size, owner distributions and nonprofit noncash assets. At this point, this is only a questionnaire and there is nothing yet definitive about it, but it implies some points that may become an issue on SBA reviews of loans. Like everything else in the program, it comes way after the fact, as many borrowers have now completed their 24-week covered period and/or have spent their PPP funds.

EDWARD MCWILLIAMS, CPA | Partner

Ed is a Partner in the firm’s tax and business advisory practice focusing on providing services to middle market private companies across different industries as well as to early stage startups. Ed has over a decade of experience providing tax and business consulting services to these companies of different sizes and across different industries, bringing a broad and diverse knowledge base and strategic solutions to the many complex issues that businesses face.