As the nonprofit sector continues to evolve, staying informed about emerging trends is crucial for adapting strategies and optimizing fundraising efforts. This article provides a comprehensive overview of the key trends shaping fundraising in 2024 and beyond.

1.) Economic Challenges and Opportunities

Impact of Inflation and Growing Competition

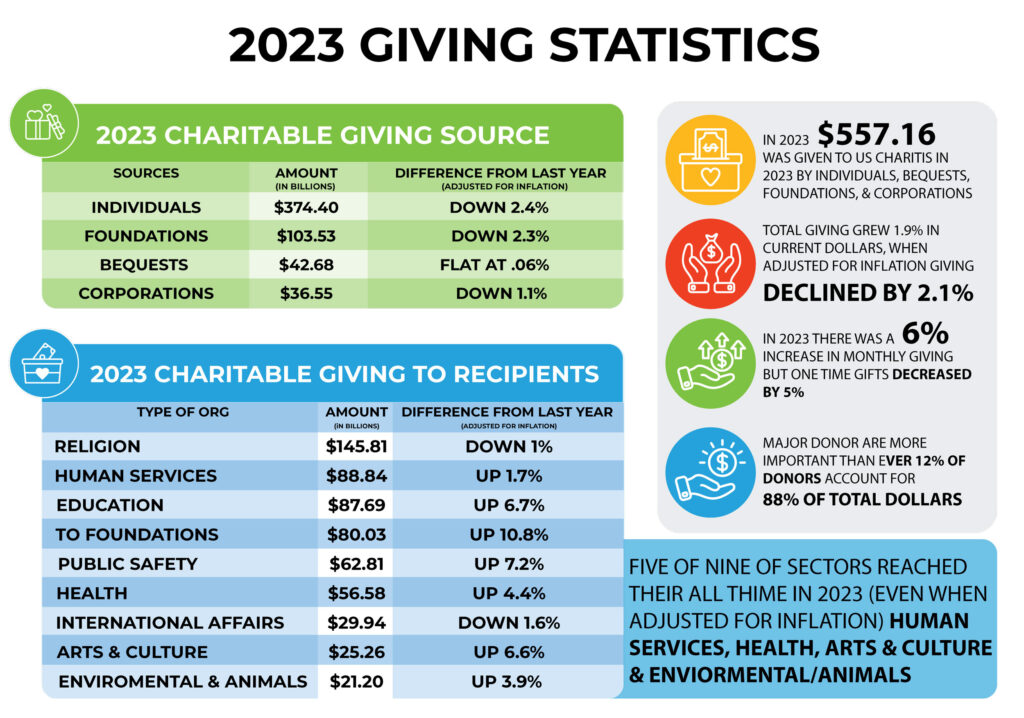

In recent years, inflation has significantly impacted charitable giving. In 2022, Americans donated $319.04 billion, a decrease from previous years. Although individual donors contributed an estimated $374.40 billion in 2023—representing 67% of the $557.16 billion total giving—this reflects only a 1.9% increase from 2022. However, when adjusted for inflation, total giving actually declined by 2.1%. Major donor contributions decreased by 10%, highlighting the need for nonprofits to diversify their donor bases and adapt their fundraising strategies.

Despite these challenges, researchers project a rebound, with giving expected to increase by 4.2% in 2024 and 3.9% in 2025. This anticipated growth presents an opportunity for nonprofits to refine their approaches and leverage the expected rise in charitable contributions.

2.) Technological Advancements in Fundraising

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning are increasingly transforming the nonprofit sector. AI is used for donor segmentation, predictive modeling, and enhancing fundraising strategies, aiming to optimize donor engagement and reduce costs. However, organizations must balance AI’s efficiencies with the need for personal interaction to avoid alienating donors.

Automation Tools

Automation tools are streamlining operations, from online donations to event planning and data analysis. These tools save time and resources but require human oversight to ensure accuracy and maintain the personal touch in donor communications.

Generative AI

Generative AI is advancing in content creation, data analysis, and donor segmentation. This technology helps tailor fundraising appeals to individual donor preferences, enhancing engagement and effectiveness. However, data security and alignment with organizational needs remain critical considerations.

3.) Shifting Donor Engagement Strategies

Diversifying Donor Bases

A trend in 2024 is the shift from major donor reliance to focusing on mid-level and monthly donors. Dana Snyder of the “Missions to Movements” podcast emphasizes the importance of diversifying donor engagement. Organizations should enhance their efforts to attract and retain monthly donors, especially as younger generations increasingly prefer consistent, smaller contributions.

Relationship-Centric Fundraising

Relationship-centric fundraising is gaining prominence as nonprofits prioritize genuine connections with donors. Sabrina Walker-Hernandez of Supporting World Hope advocates for focusing on relationships rather than transactions. By fostering authentic engagement, nonprofits can strengthen donor loyalty and improve fundraising success.

Innovation in Donor Engagement

Retaining donors is crucial for long-term success. Lynne Wester of The Donor Relations Group highlights the importance of continuous engagement through meaningful communication and appreciation. Effective donor retention involves providing personalized updates on the impact of contributions and maintaining ongoing engagement.

Preparing for Wealth Transference

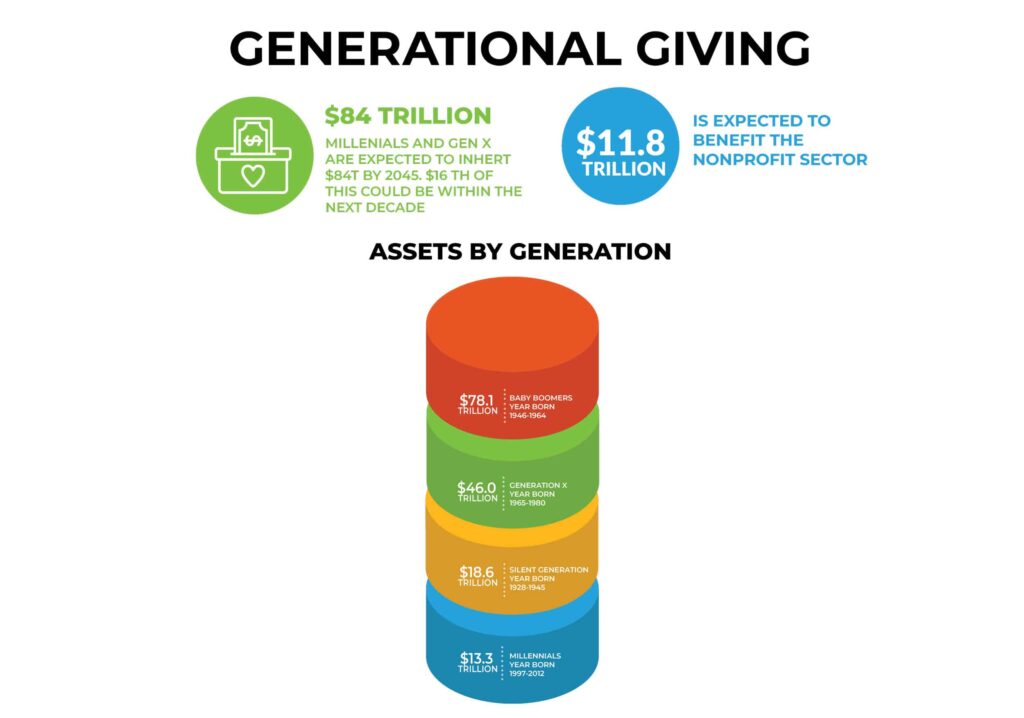

Over the next 20 to 30 years, America will see the largest level of wealth transference it has ever seen. It is expected that some $11.8 trillion will find its way to nonprofit organizations as the silent generation and the baby boomers pass on their amassed wealth. It is important for nonprofit organizations to open up communication with both their older donors, who will be transferring this wealth and their middle-aged and younger donors, who will be inheriting this wealth. This will come down to developing and strengthening relationships. With the top unified credit limit (the amount that a taxpayer can pass on to their heirs) decreasing in 2026 from $14 million to $7 million (barring a change in the tax code), including nonprofits in estate planning discussions is expected to increase.

4.) Social Media and Generational Shifts

Email Marketing Trends

Email marketing continues to be a significant tool for nonprofits, though its effectiveness is fluctuating. In 2023, nonprofits raised $76 for every 1,000 emails sent, a 15.56% decrease from $90 in 2022. Response rates to fundraising emails declined by 10% for advocacy emails and 16% for fundraising emails. Despite these declines, the number of subscribers on nonprofit email lists increased by 7%. On average, nonprofits send 59 emails per subscriber annually, with 27 being fundraising appeals. Email communications sent regularly are most likely to encourage repeat donations, with 48% of donors reporting regular email communications keep them engaged. Nonprofits should also consider that 55% of U.S. donors prefer to be thanked via email.

Social Media Utilization

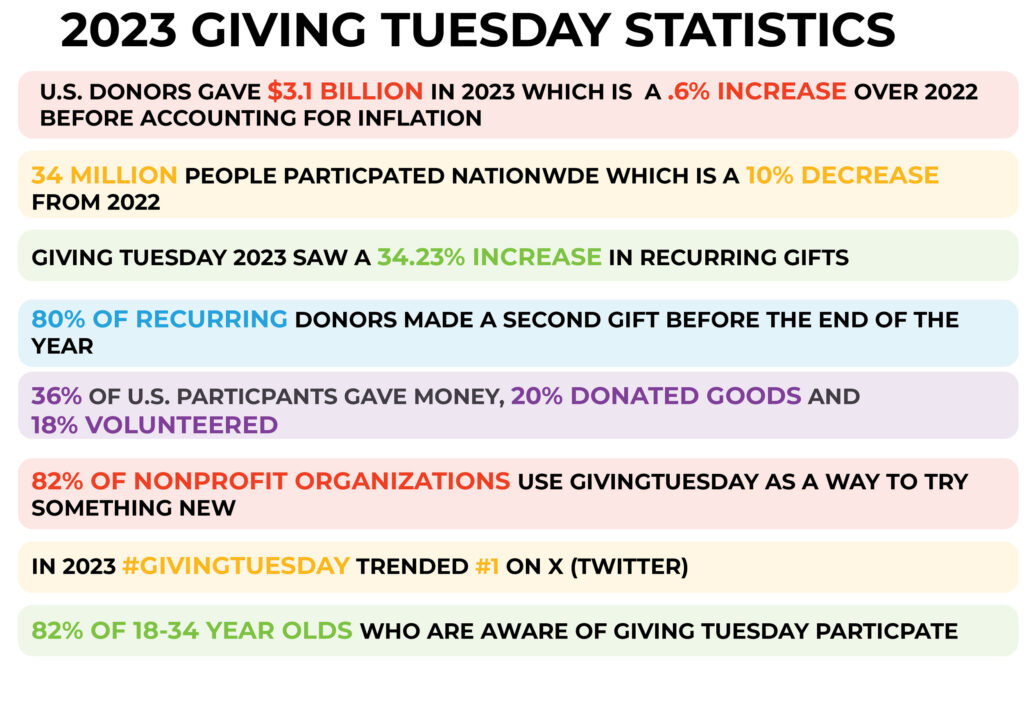

Social media remains a critical platform for fundraising. Approximately 99% of nonprofits use Facebook, 96% use Instagram, and 88% use Twitter/X. Nonprofits post frequently across these platforms, with Facebook seeing an average of 5.95 posts per week and Instagram 4.9 posts. Content that evokes a joyful emotional response tends to be the most widely shared. Social media is also a significant driver of online donations, with 32% of donors reporting that social media inspired their contributions. Nonprofits should be aware of the varied effectiveness of different platforms; 23% of marketers see Instagram as the top platform for growth, followed by TikTok (19%), Facebook (18%), and others.

5.) Generational Dynamics and Donor Preferences

Millennial Donors

Millennial donors prioritize making a difference and actively track the results of their donations, with two-thirds tracking outcomes compared to one-third of baby boomers. Mid-level donors are particularly loyal, with 52% giving to the same cause for over a decade. Additionally, 31% have made a bequest, and 23% are in the process of doing so.

Major and Mid-Level Donors

Major donors remain impactful, contributing approximately 88% of total dollars raised despite constituting just 12% of donors. Location and income are also significant factors in giving, with about 80% of donors supporting local organizations and households with incomes of $250,000 or higher being more likely to donate.

Overall Giving Trends

Educational institutions, foundations, and public-society organizations have seen the highest increases in giving. However, giving by individuals has decreased by 17.2%. Response rates to peer-to-peer campaigns and crowdfunding campaigns also reveal a trend toward new donor engagement.

As we wrap up 2024 and move into 2025, nonprofits face both challenges and opportunities. By adapting to economic shifts, leveraging technological advancements, diversifying donor engagement strategies, utilizing social media effectively, and understanding generational dynamics, organizations can enhance their fundraising efforts and achieve greater success.

Kenneth R. Cerini, CPA, CFP, FABFA

Managing Partner

Ken is the Managing Partner of Cerini & Associates, LLP and is the executive responsible for the administration of our not-for-profit and educational provider practice groups. In addition to his extensive audit experience, Ken has been directly involved in providing consulting services for nonprofits and educational facilities of all sizes throughout New York State in such areas as cost reporting, financial analysis, Medicaid compliance, government audit representation, rate maximization, board training, budgeting and forecasting, and more.