May 29, 2024

Between fundraising, marketing, and keeping your programs afloat, your nonprofit team likely collects a variety of financial data. This information is crucial in making informed decisions about resource allocation and setting your organization up to prosper for years to come.

One of the core components of proper nonprofit accounting is compiling nonprofit financial statements that allow users to assess how nonprofit management has met its stewardship responsibilities. While these documents can be overwhelming to fully understand at first, we’ll break down the key concepts related to this topic, including:

- What Are Nonprofit Financial Statements?

- Why Are Nonprofit Financial Statements Important?

- Types of Nonprofit Financial Statements Explained

- How to Best Compile Your Nonprofit Financial Statements

Since for-profit organizations use similar statements to report on their activities, we’ll point out the key differences between for-profit and nonprofit financial statements along the way. Let’s get started!

What Are Nonprofit Financial Statements?

Nonprofit financial statements are documents that summarize an organization’s financial activities and health. They report information at a moment in time (as on a balance sheet) or over a specific period (as on an income statement).

These statements are not only helpful for ensuring nonprofits use their resources effectively and make informed financial decisions but also for staying accountable to stakeholders, such as donors, grantors, board members, and the general public.

Why Are Nonprofit Financial Statements Important?

Nonprofit financial statements are important because they allow stakeholders such as donors, members, creditors, nonprofit management, and the general public the ability to assess a nonprofit’s performance and ability to continue to provide services.

In fact, nonprofit financial statements are so important that many nonprofit organizations will make their annual reports publicly available by sharing them on their website.

However, these nonprofit financial reports also have other benefits, including:

- Enhanced decision-making. With all of your essential financial information in one place, you can make well-informed decisions on behalf of your nonprofit regarding budgeting and resource allocation.

- More informed strategic planning. Similarly, nonprofit financial statements allow you to easily access the data you need to guide your strategic planning. These statements help you identify your organization’s financial strengths, weaknesses, opportunities, and risks so you can set more realistic goals and priorities.

- Better risk management. When you’re aware of potential risks that your financial statements bring to light, you can better prevent or manage them before they become larger problems.

- Increased transparency and accountability. Financial statements provide external stakeholders—such as donors, members, creditors, and the general public—with information that allows them to assess your organization’s ability to continue providing its core services. Additionally, this data helps them determine whether your nonprofit has stewarded their contributions responsibly.

Overall, nonprofit financial statements provide a snapshot of your organization’s current financial standing so you can better plan for your nonprofit’s future.

Types of Nonprofit Financial Statements Explained

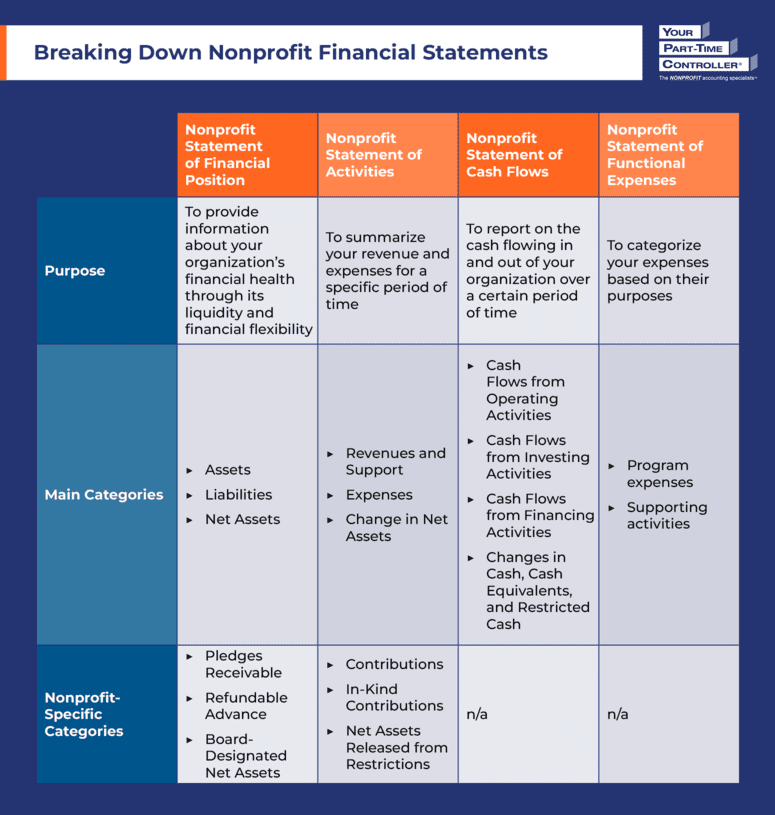

Under Generally Accepted Accounting Principles (GAAP), a complete set of nonprofit financial statements includes a nonprofit Statement of Financial Position, a nonprofit Statement of Activities, and a nonprofit Statement of Cash Flows. Nonprofits must also provide a functional expense analysis, and many organizations choose to meet this requirement using a nonprofit Statement of Functional Expenses. Let’s review each of these reports in more detail.

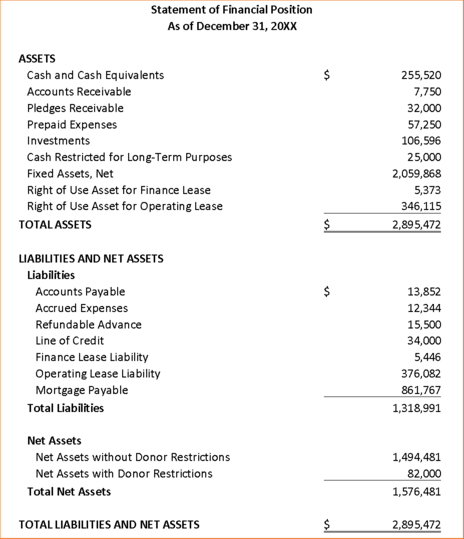

Nonprofit Statement of Financial Position

The nonprofit Statement of Financial Position, also known as a balance sheet, provides information as of a specific date about your organization’s financial health. This statement offers financial insights through your organization’s liquidity and financial flexibility—represented as assets and liabilities.

The main categories of a nonprofit Statement of Financial Position are:

- Assets. Assets are resources with economic value that an entity owns or controls. Examples of assets include current assets, such as cash and cash equivalents, accounts receivable, prepaid expenses, and inventory, and noncurrent assets, such as land, buildings, and equipment; and other assets such as restricted cash.

- Liabilities. These represent financial debts or obligations that are owed. Examples include current liabilities, such as accounts payable, accrued expenses, and deferred revenue, and noncurrent liabilities, such as mortgages or long-term lease obligations.

- Net Assets. Subtracting your liabilities from your assets determines your net assets, or the financial resources available to your organization. This equation allows you to evaluate your nonprofit’s financial standing; positive net assets indicate a healthy financial position whereas negative net assets may prompt you to reevaluate your resource allocation.

Additionally, this document contains line items that are unique to nonprofits, such as:

- Pledges Receivable. Under the assets category, this line item represents promises to donate cash or other assets in the future.

- Refundable Advance. This liability represents cash or other assets subject to donor-imposed conditions. If the conditions aren’t met, the contributed assets must be returned. For example, a donor may contribute cash to a soup kitchen under the stipulation that they serve 500 meals to low-income families. If the nonprofit does not meet this benchmark, then it must return the cash to the donor.

- Board-Designated Net Assets. These represent unrestricted net assets that a nonprofit’s board has earmarked for future programs, investments, contingencies, asset purchases, or other uses. Having board-designated net assets indicates that a nonprofit has invested in its own financial sustainability.

The Statement of Financial Position represents a snapshot of an entity’s assets, liabilities, and net assets at a moment in time. Check out an example of this statement below:

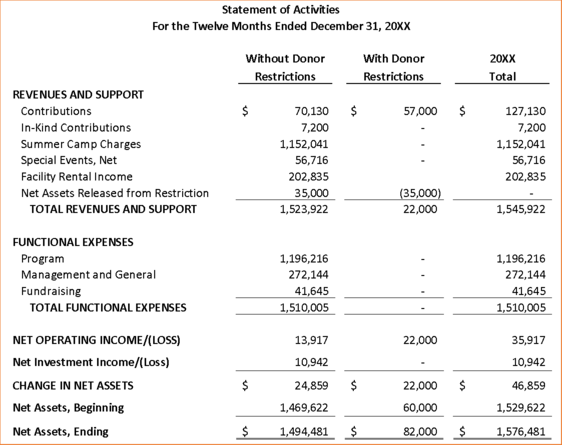

Nonprofit Statement of Activities

The nonprofit Statement of Activities also refers to your income statement. It summarizes your revenues and expenses for a specific period and allows both your organization and stakeholders to understand how you’re managing your resources.

The main categories of a nonprofit Statement of Activities are:

- Revenues and Support. This category represents resources or funds your organization receives. These may include revenue earned from selling goods and providing services or support recognized from contributions and fundraising events.

- Expenses. Expenses represent costs incurred by a nonprofit to support its programming and carry out its mission.

- Change in Net Assets. Similar to net income in a for-profit, the change in net assets represents the difference between revenues and expenses for the period.

This document also contains line items that are unique to nonprofits, including:

- Contributions. In general, nonprofits report donor-restricted contributions or donations as restricted revenues or gains, which increase net assets with donor restrictions.

- In-Kind Contributions. Nonfinancial donations, or in-kind contributions, are a separate line item. These are goods and services that your organization would have to purchase if donors did not contribute them. Common in-kind contributions include donations of land, buildings, and materials and supplies. They can also include the use of facilities or utilities and professional services, such as pro bono legal services.

- Net Assets Released from Restrictions. This category represents reclassifications of previously restricted net assets. Releases can occur when the donor’s stipulated time has elapsed or when the donor’s intended purpose for the funds has been fulfilled.

Additionally, your Statement of Activities must also report both the change in net assets with donor restrictions and the change in net assets without donor restrictions. Most nonprofits use a columnar approach to do so, like the example shown below:

Your nonprofit Statement of Activities ultimately gives stakeholders an idea of how well you’re using funds and other resources to successfully support your programming and fulfill your mission.

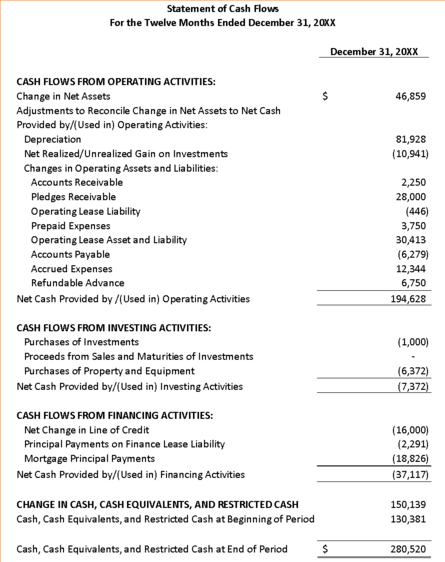

Nonprofit Statement of Cash Flows

The nonprofit Statement of Cash Flows reports on the cash flowing in and out of your organization over a certain period of time. It classifies cash as stemming from either investing, financing, or operating activities, just as the for-profit version of this document would.

Therefore, the main categories included in a nonprofit Statement of Cash Flows are:

- Cash Flows from Operating Activities. Cash inflows in this category may include funds from donations, program fees, grants, and membership dues while outflows may be staff salaries and wages, utilities, supplies, and rent.

- Cash Flows from Investing Activities. If you’ve received any proceeds from sales or maturities of your investments, you would report those as inflows in this category. On the other hand, outflows from investing activities would be the purchases of investments themselves or property and equipment.

- Cash Flows from Financing Activities. Your financing activities include borrowing funds, repaying debts, and issuing or repurchasing equity. While inflows in this category may include lines of credit and proceeds from loans, outflows would be payments of any debts, such as your mortgage.

- Changes in Cash, Cash Equivalents, and Restricted Cash. At the bottom of your nonprofit Statement of Cash Flows, you’ll note your cash, cash equivalents, and restricted cash at the beginning and end of the period to assess how your cash flows have changed over time.

Reporting noncash investing and financing activities requires separate disclosures. Examples of these activities may include receiving contributions of fixed assets or securities, purchasing a building by incurring a mortgage, or obtaining an asset by entering into a capital lease.

To put it simply, this document provides information about the cash receipts and cash payments of your organization during a specific period. You can find an example of this nonprofit financial statement below:

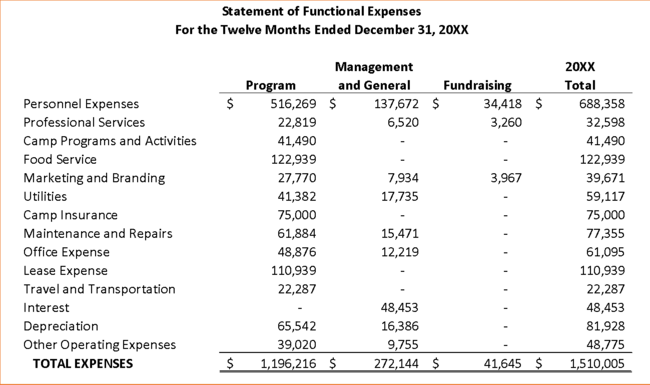

Nonprofit Statement of Functional Expenses

Nonprofits are required to provide an analysis of their expenses by nature and function. They can choose to do this on the face of their Statement of Activities, as a schedule in the notes attached to the full set of documents, or in a separate financial statement—the Statement of Functional Expenses. Most organizations choose the latter route.

The Statement of Functional Expenses reports expenses based on their nature and function. It allows you to remain transparent about your resource allocations to stakeholders and report expenses on your Form 990.

The main categories of expenses included in a nonprofit Statement of Functional Expenses are:

- Program expenses. Any costs directly tied to your services and cause fall under program expenses. For example, a summer camp paying a bus company to transport their campers to and from camp would report this cost under program expenses.

- Supporting activities. The rest of your expenses are considered supporting activities. These fall under three main categories:

- Management and general expenses, such as costs that relate to a nonprofit’s overall operations and management.

- Fundraising expenses, such as expenses incurred in soliciting cash and noncash contributions, gifts, and grants.

- Membership development expenses, such as costs incurred in soliciting new members and membership dues, membership relations, and similar activities.

List each expense by its natural classification. These may include personnel costs, professional services, office expenses, occupancy, utilities, and depreciation.

The total expenses on the statement should match the total expenses on your Statement of Activities. For a closer look at this statement, look at the example below:

How to Best Compile Your Nonprofit Financial Statements

The best way to create financial statements is to prepare them within your accounting software. Unfortunately, most accounting information systems are not equipped to adequately present nonprofit accounting data.

Without a customized software solution, many nonprofits download their accounting data to Excel to compile the information in a usable format. However, this can be extremely time-consuming for your nonprofit’s team and take energy away from focusing on your mission.

That’s why YPTC is dedicated to helping organizations like yours compile and analyze their nonprofit financial statements, on top of other nonprofit accounting services. Our nonprofit expertise, flexible services, and ability to serve you from anywhere enable us to fulfill your organization’s specific accounting needs, allowing you to do what you do best: make a difference.

If you’re ready to work with experts to properly compile and analyze your financial statements, reach out to our team. In the meantime, explore these resources to learn more about nonprofit accounting:

- Nonprofit Accounting: What Charitable Orgs Need to Know. Check out this guide for a higher-level overview of nonprofit accounting concepts.

- What Is an In-Kind Donation? The Ultimate Nonprofit Guide. One of the key line items for your nonprofit Statement of Activities is in-kind contributions. Learn more about these donations and how to properly record and report them.

- What We Do. Curious about how we can support your nonprofit beyond compiling and analyzing your nonprofit financial statements? Check out all of our nonprofit accounting and bookkeeping services.

No comment yet, add your voice below!