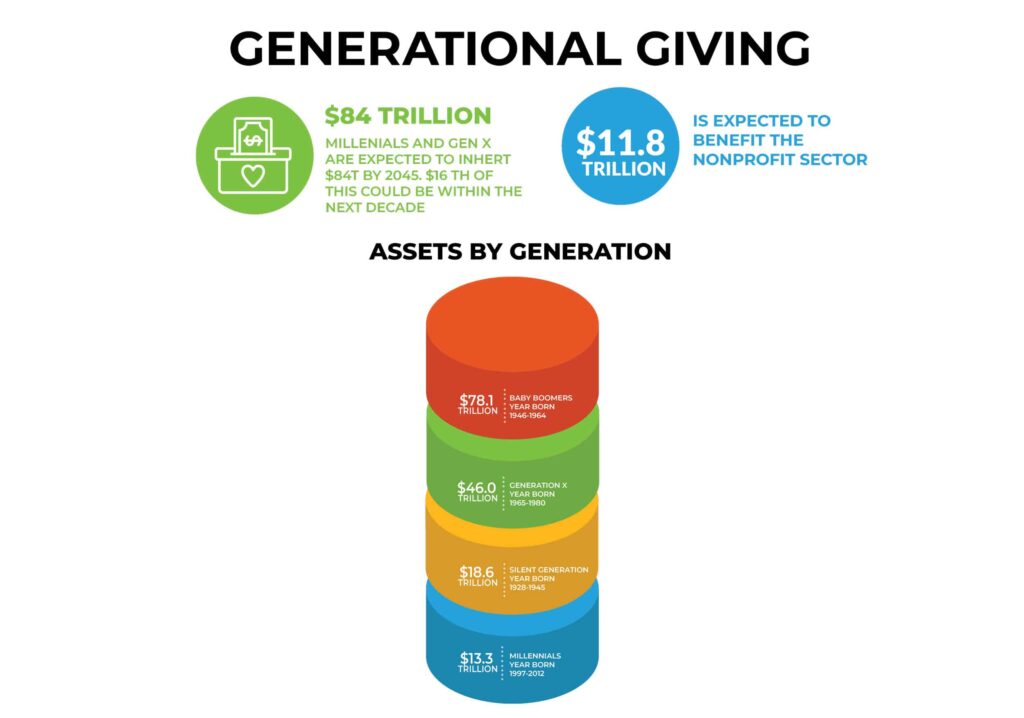

The upcoming generational wealth transfer is poised to be the largest in history, with an estimated $84.4 trillion set to be passed down from the Baby Boomer generation over the next two decades. Approximately $11.8 trillion of this wealth is expected to flow into the nonprofit sector, presenting an unprecedented opportunity for organizations to bolster their philanthropic resources.

Why This Wealth Transfer Matters

This monumental transfer of wealth represents a critical juncture for the nonprofit sector. Baby Boomers, born between 1946 and 1964, have accumulated substantial wealth over their lifetimes, with average net worths ranging from $970,000 to $1.2 million. As this wealth transitions to younger generations, particularly Millennials, the philanthropic landscape is expected to evolve. For nonprofits, this wealth transfer is not just a chance to receive donations but a pivotal opportunity to secure their financial future and expand their impact.

Ensuring Nonprofits Receive Their Share of the Wealth

To capitalize on this wealth transfer, nonprofits must implement strategic approaches that resonate with both Baby Boomers and the generations inheriting their wealth. Here are key strategies nonprofits can adopt to ensure they receive a portion of these donations:

1.) Enhance Planned Giving Programs

Planned giving is one of the most effective ways for nonprofits to secure a portion of this wealth transfer. With 90% of planned gifts being bequests, nonprofits should focus on making planned giving accessible and appealing. This can be achieved by simplifying the process, providing clear and concise information, and sharing compelling stories of how planned gifts have made a difference. By educating donors about the long-term impact of their contributions, nonprofits can encourage more bequests.

2.) Tailor Engagement Strategies to Generational Preferences

Different generations have varying philanthropic behaviors and expectations. For instance:

- Generation X values pragmatism and independence, often preferring digital platforms for giving and supporting causes that directly impact their communities.

- Millennials seek transparency, social impact, and alignment of causes with their personal values. They are more likely to engage with nonprofits that demonstrate a clear, measurable impact.

Nonprofits must tailor their engagement strategies to meet these generational preferences, using diverse giving channels and leveraging technology to enhance the donor experience.

3.) Engage Women as Philanthropic Leaders

With women projected to control two-thirds of U.S. wealth by 2030, and already exerting significant influence over charitable decisions, nonprofits must prioritize engaging women in their fundraising efforts. This can be done by designing programs and communications that resonate with their specific philanthropic motivations, such as supporting causes related to education, healthcare, and social justice.

4.) Leverage Technology and Innovation in Fundraising

As digital engagement continues to grow in importance across all generations, nonprofits should integrate advanced technological tools into their fundraising strategies. This includes offering mobile giving options, utilizing social media for campaigns, and employing data analytics to personalize donor experiences. A tech-savvy approach not only attracts younger donors but also streamlines the donation process, making it easier for all donors to contribute.

The Importance of Engaging Younger Donors

As wealth transfers to younger generations, the future of philanthropy will increasingly depend on the engagement of Millennials and Generation Z. These generations are not just inheritors of wealth; they are shaping the future of giving with their emphasis on transparency, social impact, and digital engagement.

Nonprofits that actively engage younger donors, by aligning their missions with the values and expectations of these generations, will be better positioned to secure sustained support. This includes offering clear evidence of impact, fostering genuine connections through digital platforms, and creating opportunities for younger donors to be involved in decision-making processes.

Securing the Future of Philanthropy

The Great Wealth Transfer is a once-in-a-lifetime opportunity for nonprofits to secure transformative levels of funding. By understanding the scale of this transfer, adopting strategic approaches to planned giving, tailoring engagement to generational preferences, and prioritizing the engagement of younger donors, nonprofits can position themselves to benefit from this unprecedented shift in wealth. As we move into this new era of philanthropy, the success of nonprofit organizations will depend on their ability to be forward-thinking, adaptable, and deeply connected to the evolving landscape of donor expectations.

Tania Quigley, CPA

Partner

Tania Quigley has been a member of Cerini & Associates’ audit and consulting practice area since 2005 where she focuses on serving the firms nonprofit and employee benefit plan clientele. Tania has experience in performing financial statement audits and reviews, tax return preparation, cost report preparation and filing, retirement plan audits, and other consulting. Tania brings her expertise, diversified background, and helpful approach to all of her engagements.

No comment yet, add your voice below!