June 11, 2024

Let’s say you run a small nonprofit that provides educational support for youth in the Dallas, Texas area. Until now, your finance team has sufficiently managed your funds, but a recent major donation has allowed your organization to significantly grow its programming and support many more local children. While this is great news, your finance team has become overwhelmed with the influx of resources and needs support to steward funds appropriately.

In this scenario, your organization would benefit from hiring a fractional chief financial officer (CFO) to provide interim support and lend their financial expertise. Throughout this guide, we’ll get you up to speed on everything you need to know about fractional CFOs, answering the following questions:

- What Is a Fractional CFO?

- What Does a Fractional CFO Do?

- What Are the Benefits of Hiring a Fractional CFO for Nonprofits?

- What Should My Nonprofit Look for in a Fractional CFO?

- Why Is YPTC the Best Choice for Fractional CFO Services?

At the end of this article, you’ll be equipped to make a well-informed decision about whether your nonprofit needs fractional CFO services and how you can find the best provider for the job. Let’s dive in!

What Is a Fractional CFO?

A fractional CFO provides financial services and expertise on a part-time basis. Instead of hiring an in-house CFO and paying the typical full-time staff costs, nonprofits can benefit from accessing that same knowledge as needed for a lower price.

Fractional CFOs may be retired certified public accountants (CPAs), certified management accountants (CMAs), or finance professionals who still want to lend their expertise to businesses and organizations in need. They can also be actively working professionals who enjoy the flexibility and autonomy that fractional CFO work provides.

What Does a Fractional CFO Do?

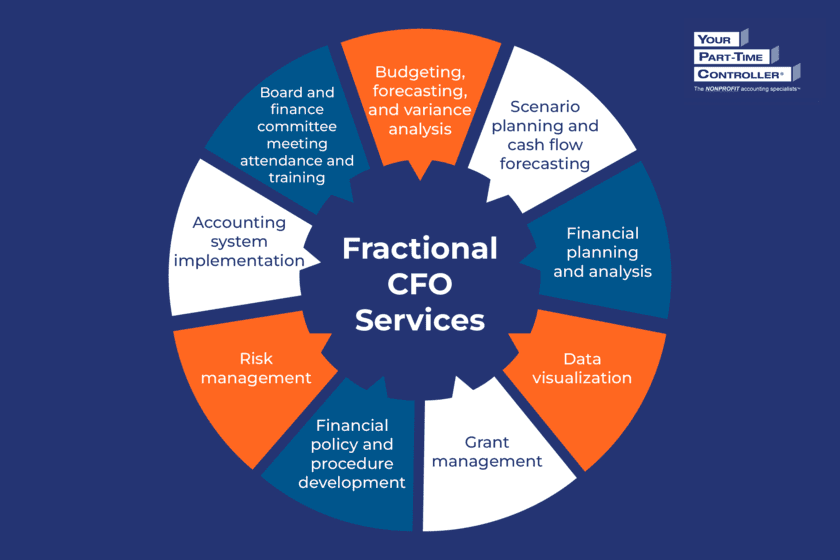

A fractional CFO can help nonprofits by providing a variety of financial services, such as:

- Budgeting, forecasting, and variance analysis. Need help with the budgeting process? A fractional CFO can assist you with allocating resources—both cash and in-kind—and monitoring budget performance to ensure your nonprofit stays on track.

- Scenario planning and cash flow forecasting. Your fractional CFO can help you stay prepared for the unexpected and prepare cash flow reports monthly, quarterly, or annually, depending on your organization’s needs.

- Financial planning and analysis. A fractional CFO can also help you plan for the future of your organization through careful analysis of key financial metrics and goal setting within your strategic plan.

- Data visualization. Better understand your organization’s financial standing with charts, graphs, and dashboards created by your fractional CFO.

- Grant management. Let your fractional CFO handle incoming grants with proper recording and classification, allocation methodologies, reporting requirements, and requests for reimbursements in mind.

- Financial policy and procedure development. To set your organization up for long-term success, a fractional CFO will help you strengthen your internal controls and keep your financial policies and procedures up to date.

- Risk management. Rest assured knowing your fractional CFO will identify, assess, and mitigate any imminent financial risks and keep your team apprised of any vulnerabilities you need to address.

- Accounting system implementation. Your fractional CFO can oversee the implementation of your new accounting system or software, ensuring you choose the right platform for your organization’s needs, set it up correctly, and migrate all necessary data from your existing system or spreadsheets.

- Board and finance committee meeting attendance and training. Lastly, a fractional CFO can sit in on board meetings and provide financial guidance and training as necessary.

Since fractional CFOs work on an as-needed basis, you can pick and choose which services your organization needs to personalize your arrangement with them.

What Are the Benefits of Hiring a Fractional CFO for Nonprofits?

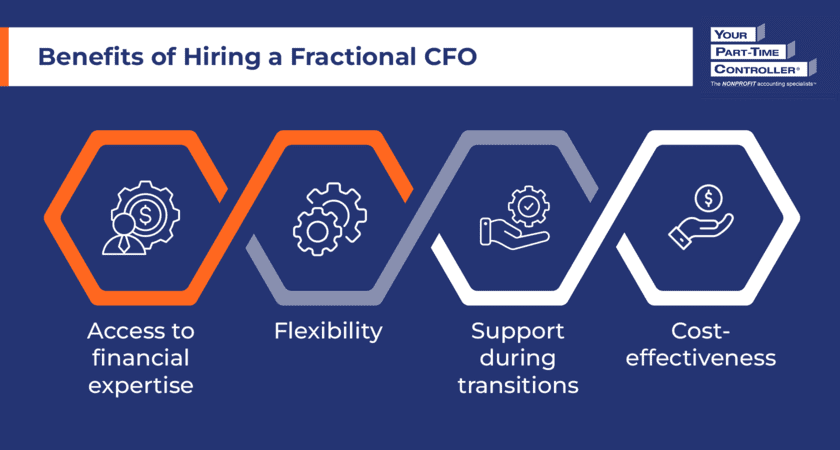

As you’ve seen in the previous section, fractional CFOs offer many different financial services to organizations like yours. When you hire a fractional CFO for nonprofits, you’ll unlock the following benefits:

- Access to financial expertise. Bringing on a fractional CFO provides your organization with a point person for all financial questions and challenges. They can guide your team to ensure strong financial management and sustainability for your nonprofit.

- Flexibility. You can scale your fractional CFO services up or down depending on your organization’s current needs or budget constraints, allowing for flexibility that hiring a full-time team member doesn’t offer.

- Support during transitions. If you’re in a period of leadership transition, organizational growth, or financial restructuring, a fractional CFO is a great option in the interim. In the case of our opening example, a fractional CFO may step in until the nonprofit hires a full-time CFO or stick around as the organization continues to grow.

- Cost-effectiveness. Since many nonprofits have tight budgets, they often turn to fractional CFO services, as it’s more cost-effective to pay a fractional CFO on a part-time or as-needed basis than it is to hire a full-time staff member.

Hiring a fractional CFO allows you to be confident in your nonprofit’s financial management and decision-making and enables you to focus more time on fulfilling your mission, enhancing your programming, and working with your beneficiaries.

What Should My Nonprofit Look for in a Fractional CFO?

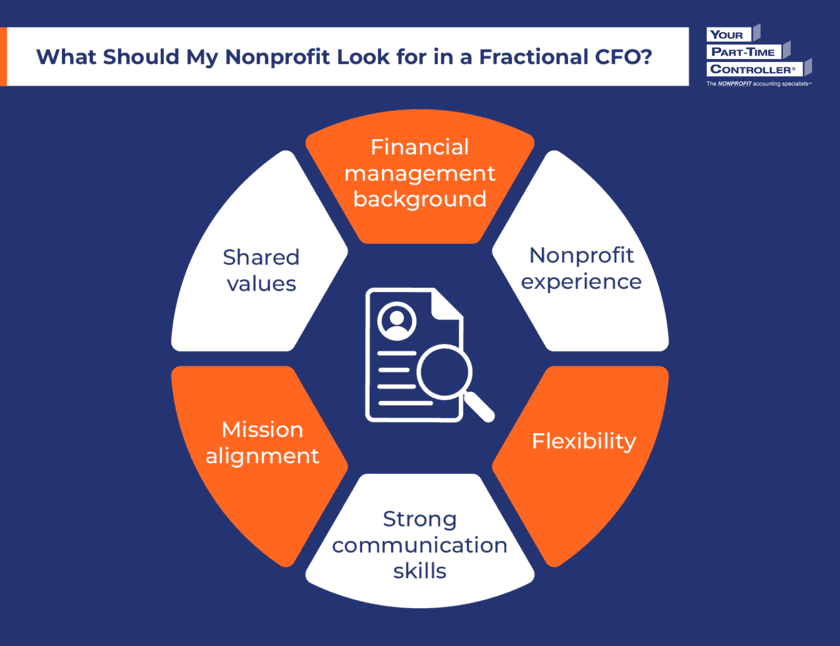

Just as you would when hiring for any other position on your nonprofit’s team, you should make a list of qualities that your ideal fractional CFO would have. To get you thinking, we recommend looking for a fractional CFO who:

- Has a background in financial management. First and foremost, your fractional CFO should have expertise in finance and accounting principles to guide your team in these areas. You may screen resumes for past financial roles, relevant certifications, or prior experience in the field.

- Has experience working with nonprofits. Not only should your fractional CFO know how to manage your finances, but they should also know the ins and outs of nonprofit-specific financial management. Look for candidates who have worked with nonprofits in the past, and ask them about their experiences to assess their familiarity with your organization’s type.

- Has strong communication skills. Since your fractional CFO will be responsible for conveying financial information and recommendations to your nonprofit’s team and stakeholders, they must be able to communicate clearly and concisely.

- Will customize their approach to your organization’s needs. One of the reasons why you may opt for fractional CFO services in the first place is their flexibility and customizability. Your fractional CFO should take a collaborative approach to their work, consulting your team on which services you need and adapting their efforts as your organization grows and changes.

- Aligns with your mission. Your mission is the guiding force behind your nonprofit’s important work. Anyone who works for your organization should fully understand and believe in your mission so they’re motivated to put their best foot forward.

- Reflects your organization’s culture and values. Additionally, the best candidates will fit in with your company culture and act as a natural extension of your team. If your organization has specific principles your team abides by, share these during the interview process to ensure your fractional CFO is aligned with your internal values.

Ideally, your fractional CFO will have the financial expertise needed for the job, the typical qualities of a high-performing employee, and an understanding of your nonprofit and its mission that drives their work forward.

Why Is YPTC the Best Choice for Fractional CFO Services?

Now that you have a clearer understanding of what a fractional CFO does, you probably have a better sense of whether your organization would benefit from investing in these services. If you’ve decided your nonprofit is ready to hire a fractional CFO, YPTC is equipped to become your organization’s fractional CFO and lend our financial expertise to your team.

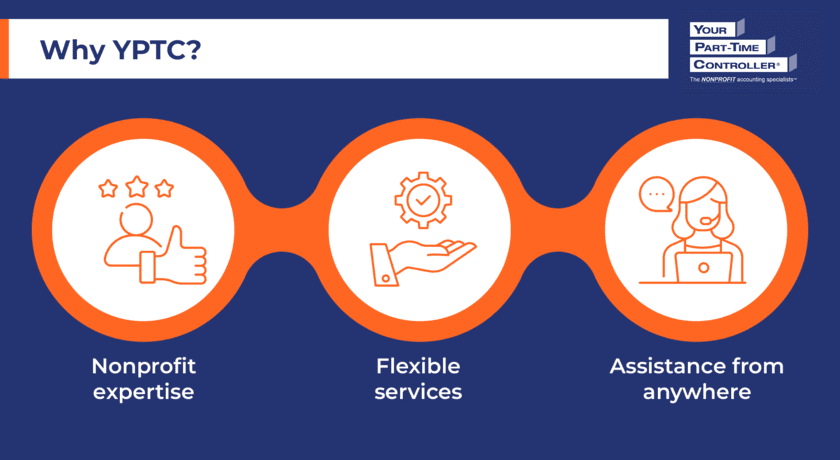

With several options out there, why is YPTC the best choice for fractional CFO services? Our firm stands out amongst the crowd due to our:

- Nonprofit expertise. Our mission is to help you fulfill your mission through careful financial management. For three decades, we’ve worked exclusively with nonprofit executive directors and board members so they can focus on their causes and leave the financials to us. We’ve successfully partnered with associations, foundations, faith-based organizations, libraries, museums, youth development organizations, and everything in between, dedicating our time to fully understand each nonprofit’s unique mission and operations.

- Flexible services. YPTC takes flexibility to the next level. While we can become your fractional CFO, we can also serve as your nonprofit’s bookkeeper, accountant, or controller, depending on your organization’s needs. Our services span from budgeting to financial planning to accounting and will allow your team to rest assured you’re leaving it up to professionals.

- Assistance from anywhere. While working face-to-face allows your organization to get to know our team members and easily ask them questions, we understand that this setup isn’t always feasible. At YPTC, we can work with your organization no matter where you’re located, using tools like video chat, phone calls, and emails to get the job done remotely.

Whether you’d like us to work as your fractional CFO for a short interim or the long haul, we’re thrilled to learn about your nonprofit’s important work and start assisting your organization with its financial management needs to set you up for continued success. Take a look at how different organizations have leveraged our fractional CFO services to fulfill their needs:

- “A board member had recommended YPTC when we lost our CFO, to help us out until we figured out what we wanted to do…It’s a great organization to go to these days when it’s so hard to hire people. You’re looking for quality candidates who not only have the technical abilities but also the personality to fit into your team. YPTC gives you breathing room so you don’t have to hire the first person you find.” – Manuel Salazar, Take Charge America Chief Executive Officer

- “YPTC is amazing. We’ve come miles away from where we were. We know we’re learning from the best experts out there for knowledge and support. They’re helping us to be fiscal stewards of our dollars. They’ve done so much to help us get our house in order. You don’t have to hire someone in-house when you have an amazing organization like this.” – Melissa Steimer, Gabriel’s Angels Chief Executive Officer

- “What started out as a turnaround became a crisis. But [YPTC Associate] Mike has been my godsend. He is, by all accounts, my CFO. He goes with me to finance committee and board meetings, and the board has 110% confidence in his abilities. He’s phenomenal. Because of Mike, I don’t have to hire a CFO.” – Geri Wright, Arizona Theatre Company Executive Director

If you’re ready to work with YPTC for fractional CFO services or any other financial management needs, contact us today so we can dive into your organization’s background, mission, and needs and get started. To learn more about effective financial management, check out these resources:

- Nonprofit Accounting: What Charitable Orgs Need to Know. There are several key differences between for-profit and nonprofit accounting. Learn the distinctions, the types of nonprofit accounting statements and reports, and nonprofit accounting best practices in this guide.

- What Is an In-Kind Donation? The Ultimate Nonprofit Guide. Nonprofits must properly record and report on the in-kind donations they receive. Explore the basics of in-kind donations and how and when to record and report them.

- What We Do. While we offer fractional CFO services, we provide so much more than that. Take a look at our full range of services to determine how we can best assist your nonprofit.

No comment yet, add your voice below!