By Joseph Barretto

For most of 2020, nonprofit organizations that were in the midst of—or getting ready to take on—strategic planning quickly abandoned the notion. What, after all, does it mean to plan for the organization’s direction for the next three years, when they didn’t know what the next three months or even the next three weeks would look like? Many leaders understandably turned their attentions to more immediate matters such as programmatic restructuring and reimagination, short-term scenario planning, and emergency fundraising.

But 2020 was also a year rich in realizations. For many, the time of uncertainty distilled for them the essence of what is important and critical for their organizations. Forced to prioritize programs and initiatives that were mission-focused, they put on hold anything that represented mission creep. They also realized that many items they once considered “nice to haves” (such as a reserve fund or a more engaged Board of Directors) are, in fact, “need to haves” in times of uncertainty. Relatedly, they found out that some actions they’ve long placed in the back burner (such as strengthening staff culture or centering diversity, equity, and inclusion) must now be put front and center.

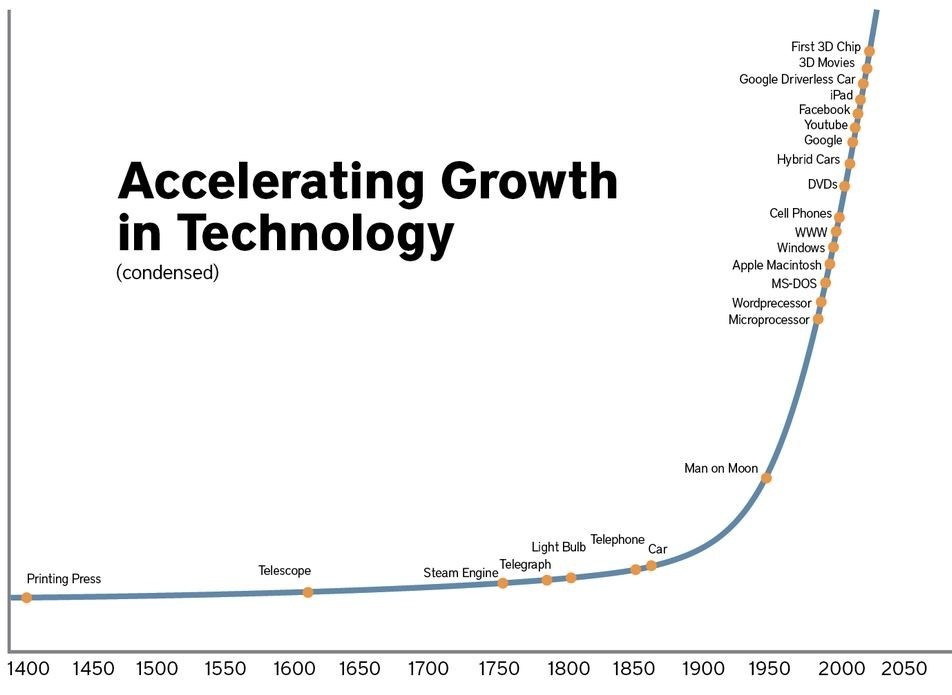

In the face of all these realizations, it is no surprise that leaders are returning to strategic planning as a critical management tool to help them establish direction and determine priorities. But planning has to change to remain relevant today. The traditional linear six-month long strategic planning process can prove inadequate during times of uncertainty. It requires too much time and attention that staff and board members don’t necessarily have. In the amount of time it takes to gather information and form strategies, the environment may have already shifted – rendering the analysis outdated. Moreover, the rigid process often results in static plans that are not adaptable, become obsolete right away, and are quickly shelved and forgotten.

Figure 1. The traditional linear six-month long strategic planning process can prove inadequate during times of uncertainty.

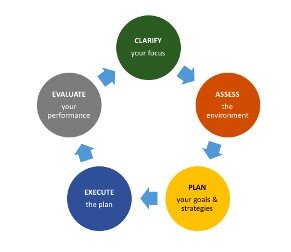

A more agile strategic planning process is needed today.

There are a few key shifts in the planning process that can make it more useful during uncertain times. Rather than a linear process, agile strategic planning is best seen as a cyclical one. More emphasis is placed on clarifying your organization’s focus; this involves more than simply reaffirming your mission and going quickly into discovery and research. Rather, you might spend more time in internal discussions to confirm your purpose and define your model. For many, this can take the form of creating (or updating) your Theory of Change. That can be a time-consuming and difficult activity, but one that can be well worth the effort. By taking the time to define your “North Star,” you can transform this part of the process from simply being a jumping off point for planning into a dynamic guide for decision making for the organization.

Figure 2. Rather than a linear process, agile strategic planning is best seen as a cyclical one.

Agile strategic planning also shifts the timing in which organizations go through the steps in the process. In traditional strategic planning, organizations go through the steps (from preparation and launch through to adoption and integration) once and only return to these steps the next time they take on strategic planning – almost always after the current one’s completion, which can be years later. In agile strategic planning, organizations go through the cycle during the planning process and continue to do so throughout the plan’s implementation. In this version, organizations are able to take in and react to new information and shifting situations while keeping its focus, its “North Star,” in mind. The key to agility is not just to react swiftly but to move while maintaining balance and keeping to your intended direction. In addition, by going through this iterative process on an ongoing basis, organizations build in reflection and learning into their day-to-day systems and create a feedback loop that helps improve their work and maximize their impact. What agile strategic planning aims to achieve is to have organizations keep in mind both its longer-term goals and new information gathered within shorter horizons, allowing them to act quickly – but not reflexively – to emergent realities.

This key shift in an agile strategic planning process puts a greater emphasis on learning the skills involved in planning. Rather than working with a consultant who will gather the necessary information and provide you with a completed plan, this process often involves a consultant who will also coach and teach you the necessary skills to take on strategic thinking. During the process, organizations should gain a better understanding of how to think strategically and build their skills to do ongoing planning in the future. Ultimately, strategic planning should not only result in a plan, it should also make organizations more strategic, allowing them to better meet the challenges of a dynamic environment.

Joseph J. Barretto is a management strategist with 20 years of experience in the nonprofit sector. His expertise includes organizational strategy and leadership development, building the capacity of organizations to ensure their sustainability and maximize their impact.