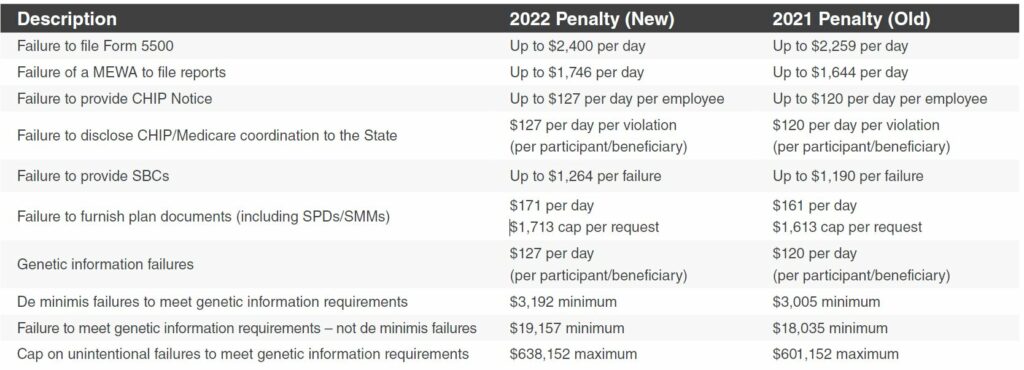

The Department of Labor (DOL) published the annual adjustments for 2022 that increase certain penalties applicable to employee benefit plans.

Annual Penalty Adjustments for 2022

The following updated penalties are applicable to health and welfare plans subject to ERISA.

Description

Employer Action

Private employers, including non-profits, should ensure employees receive required notices timely (SBC, CHIP, SPD, etc.) to prevent civil penalty assessments. In addition, employers should ensure Form 5500s are properly and timely filed, if applicable. Finally, employers facing document requests from EBSA should ensure documents are provided timely, as requested.

For more information: Ed Probst | (516) 872-2017 | contact@vgdny.com

No comment yet, add your voice below!